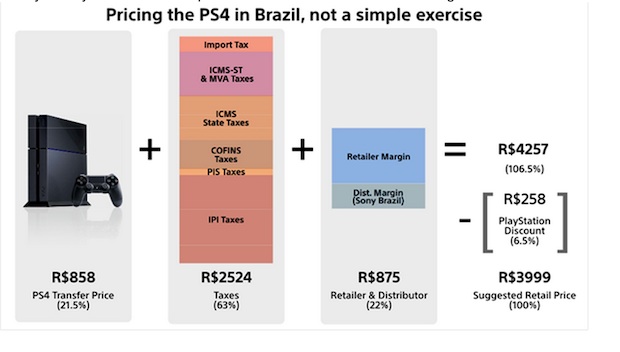

Here’s how that $1,850 breaks down

We were just as shocked as you were to hear that the PS4 would cost about $1,850 in Brazil. Sony sent us a statement from PlayStation Latin America that looks to show all the pieces of the R$3,999 puzzle. It says that they “heard your frustration loud and clear about the PlayStation 4 retail price,” and that they want to emphasize that “it isn’t in the interest of Sony Computer Entertainment America to sell PS4 units at this high retail price.”

In an effort to be transparent, they sent along a breakdown and graph of the crazy taxes involved in the Brazil PS4 pricing. About 63% of that price goes to various taxes tied to importation.

Sony says that they’ll continue to talk to government agencies to reduce this tax, and that they’re looking at possibly manufacturing the PS4 locally, which would reduce the retail price greatly. They did this with the PS3 recently.

“We are doing everything possible at this moment to reduce the PS4 price for you,” Sony’s statement said.

We have read thousands of your comments and heard your frustration loud and clear about the PlayStation 4 retail price of R$3,999 in Brazil. We want to emphasize that it isn’t in the interest of Sony Computer Entertainment America to sell PS4 units at this high retail price, as it’s not good for our gamers and it’s not good for the PlayStation brand. We have always maintained an open and honest dialogue with PlayStation Nation in Brazil, we want to be fully transparent as to what makes up this price, so gamers can be fully informed and make their own conclusion.

There is a lot of confusion and inaccurate information spreading online about Brazil’s import tax policies online and the PlayStation 4 retail price, so we’d like to set the record straight: of the R$3,999 gamers pay, 63% of the retail price goes to offset the various taxes that are applied in the process of importation. Some do not consider the IPI on the distributor price and PIS/COFINS on retailers price and much less, include the ICMS and ICMS-ST taxes. You can see a true breakdown of the price model at Valor Economico http://www.valor.com.br/

empresas/3311186/sony-vai- acelerar-producao-local-do- playstation-4-para-reduzir- preco. The other 15.5% goes to retailer margin and 21.5% to PS4 Transfer Price (equivalent to USD$390).

We will continue to talk with the relevant government agencies to help us reduce the heavy tax burden that gamers, retailers and Sony Computer Entertainment America are paying.

Our primary focus right now is to ensure we are in full compliance with Brazilian import tax laws and look ahead the opportunity to locally manufacturing the PS4, which will significantly reduce the retail price. Sony Computer Entertainment began locally manufacturing PlayStation 3 in Manaus this past May and it immediately made PS3 more affordable to gamers in Brazil. PlayStation is fully committed to Brazilian gamers and we are proud of the strong relationship we’ve been able to build over the years. We are doing everything possible at this moment to reduce the PS4 price for you.

Thank you for your thousands of passionate comments…we are in this together!

Published: Oct 22, 2013 08:51 am